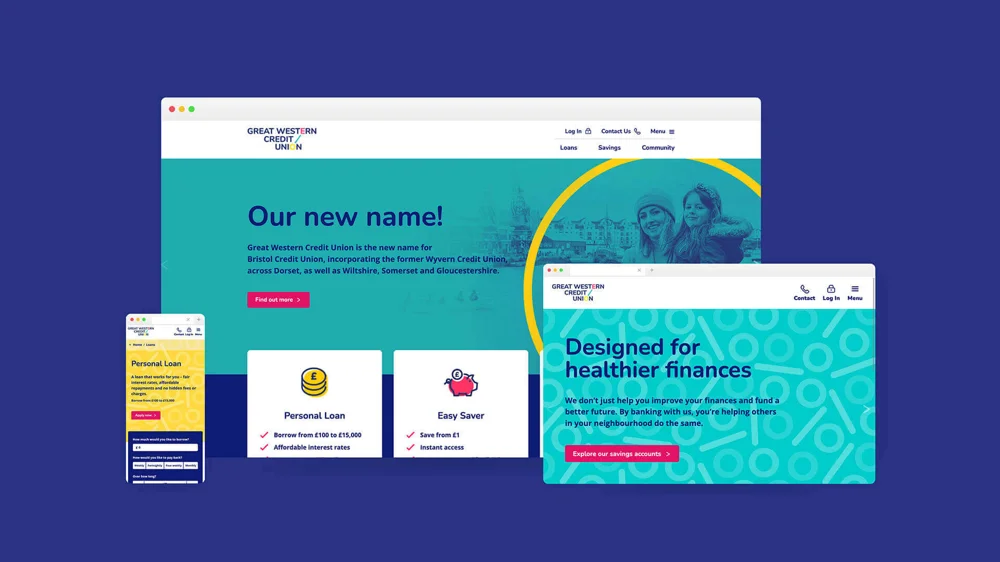

Digital transformation to revolutionise community banking

Modernised lending process and expanded access to ethical finance with a secure, mobile-first digital transformation.

Modernised lending process and expanded access to ethical finance with a secure, mobile-first digital transformation.

Great Western Credit Union (GWCU) has been a pillar of financial wellbeing in its community, supporting thousands with affordable and ethical financial services. However, in 2019, its outdated systems created barriers to growth, efficiency, and user experience. With an ambition to expand its reach and improve access to fair financial solutions, GWCU embarked on a major digital transformation.

GWCU's goals were twofold: modernise its technology to better serve existing members and build a scalable, agile infrastructure to drive future growth. To achieve this, GWCU needed a digital solution that was secure, efficient, and user-friendly. This solution would enable it to compete with high-street banks and payday lenders while staying true to its values.

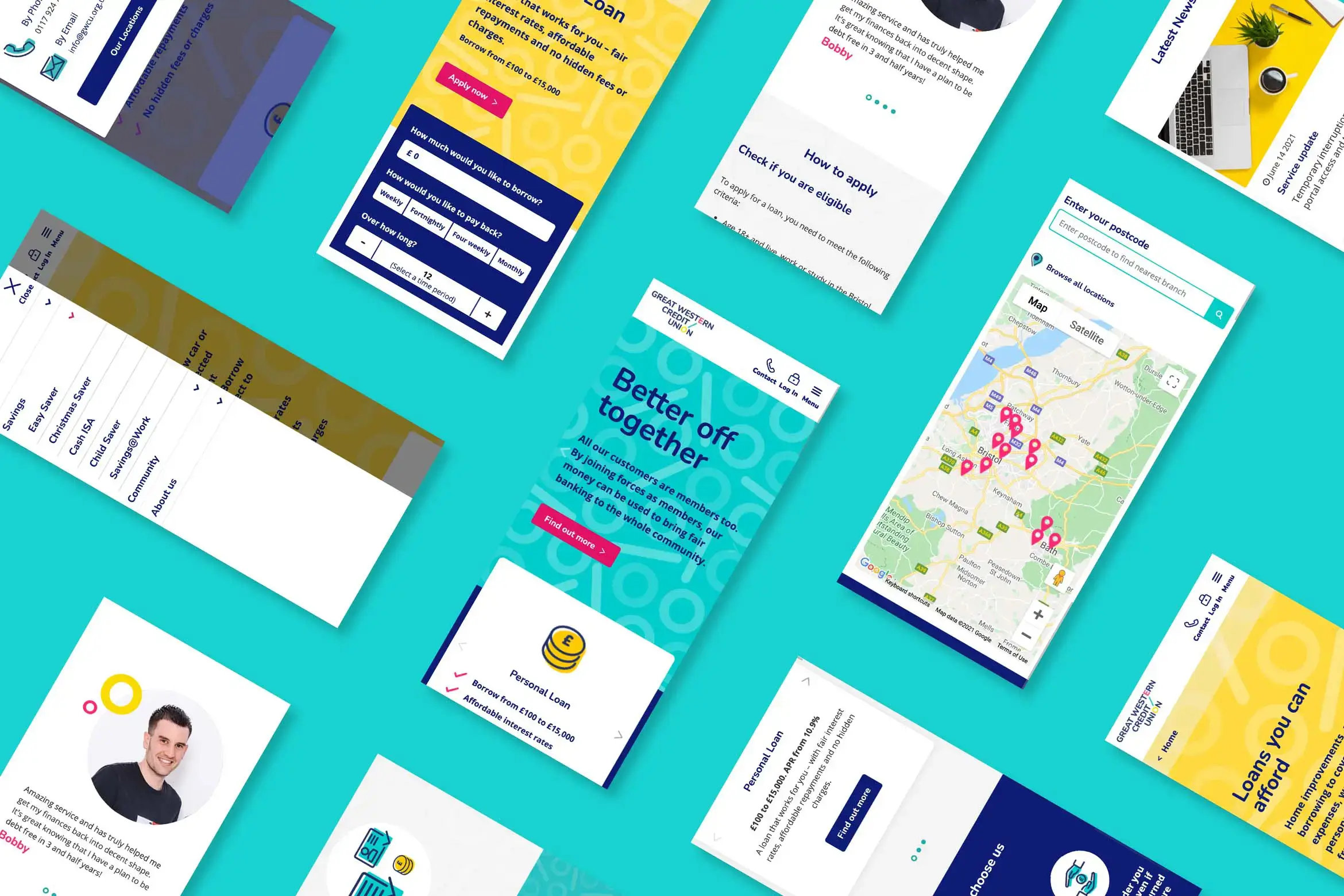

The first step in GWCU’s transformation was replacing its legacy systems with a future-ready digital ecosystem. This included:

Through a collaboration with Microsoft Cloud experts Chorus and infrastructure specialists ADT Systems, GWCU ensured its platform was not only scalable but also secured by bank-grade security protocols, including multi-factor authentication and fraud prevention.

Recognising that modern banking demands frictionless digital interactions, GWCU prioritised user experience (UX) in its transformation:

By removing inefficiencies and simplifying digital interactions, GWCU made ethical banking as seamless as mainstream financial services, without compromising on fairness or security.

Since implementing its digital transformation, GWCU has:

By embracing technology with purpose, GWCU has reinforced its mission: to provide fair, ethical, and accessible financial services—delivering real social impact across its community.

Increase in loan applications

Decrease in number of actions to complete an application

Number of days taken to process an application

We’d love to hear your story.