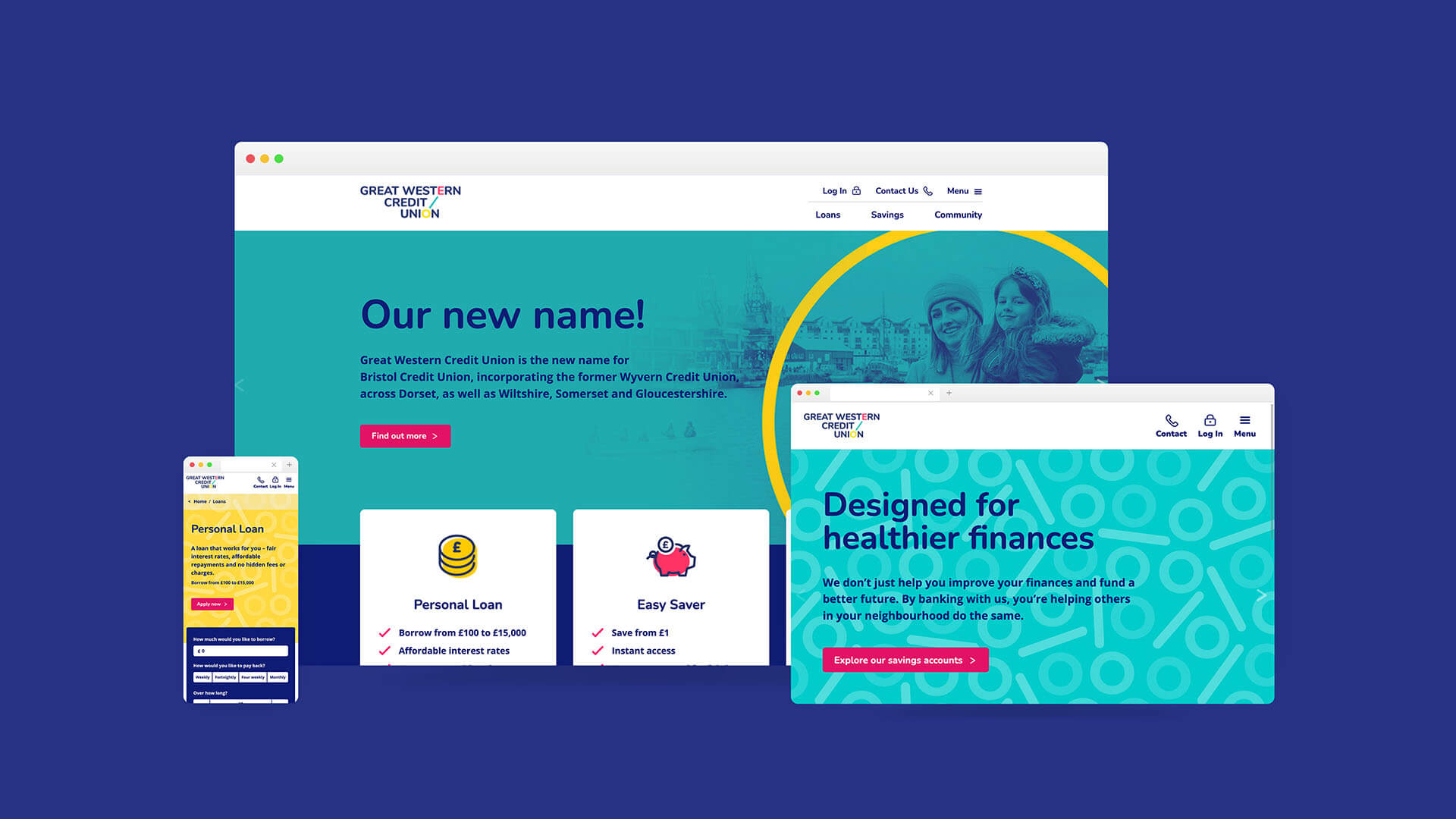

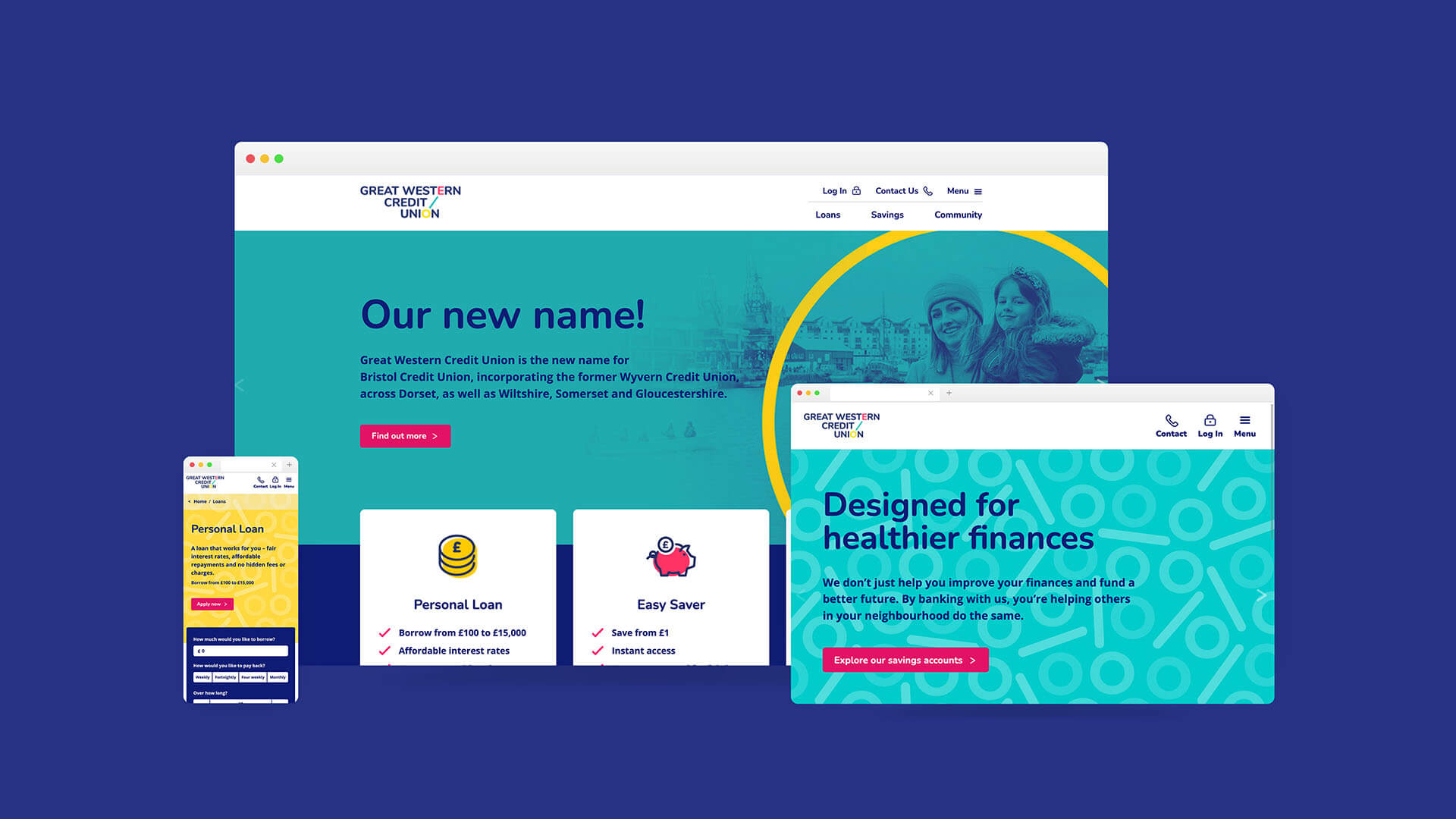

Great Western Credit Union

Creating seamless customer experiences to better financial wellbeing

Great Western Credit Union (GWCU) has supported the financial wellbeing of thousands in their community, through the transformation of their loan applications, bringing low-cost ethical financial support to the people that need it at speed.

Powered by over 20,000 local members, GWCU’s mission is to make the communities and people it serves better off, by providing access to credit for those in need together with responsible financial advice and ethical loan and savings opportunities.

In 2019 achieving their mission in a fast-moving and competitive marketplace, was proving highly challenging. GWCU needed to embark on a seismic technological shift. Their antiquated systems were no longer fit for purpose, resulting in data duplication, inefficient workflows and a lending experience that didn’t meet the needs or expectations of their mobile-first audiences.

Their remarkable journey has seen the organisation radically modernise and digitise its entire operations and their transformation has resulted in GWCU now being one of the largest cooperatives in the South West.

GWCU approached us with sizeable ambitions. Their goal was geographical expansion, yet their immediate desire was to offer a more inclusive, accessible, and agile lending experience to its members. The organisation wanted to create greater social impact and help people in their community to better manage their funds and receive access to affordable and flexible credit solutions.

Recognising that the bank’s use of technology must adapt to enable their strategic goals to be met, board members agreed an extensive transformation programme was needed, and so began the exploration into what GWCU, then Bristol Credit Union, could become.

"Digital Wonderlab’s clear focus has led to a truly connected tech ecosystem, with a number of solutions seamlessly working together in the background to really support our members. We now present a much more modern and device-responsive impression to the world, and tech is making a big difference in allowing us to achieve our strategic direction."

"The online application process is really easy and what I like about BCU is the personal touch. I feel like they properly consider my personal circumstances rather than the “computer says no” automated approach you get with other lenders."